Finance

Crypto Assets: A Guide to Unlocking the Rewards of Cryptocurrency Faucets

Getting cryptocurrency assets is pretty straightforward – all you have to do is visit a crypto exchange, create an account, and follow the necessary instructions to buy your desired crypto assets. But there’s an easier method to do it that doesn’t require you to spend any money.

You just have to complete a simple task, and you’ll be the proud owner of some crypto assets courtesy of a crypto faucet.

So, in this article, you’ll find everything you need to know about crypto faucets, from what they are, how they work, and how to choose the right one.

What Are Crypto Faucets?

Crypto faucets are websites and apps that offer small amounts of cryptocurrencies as a reward for completing simple tasks. However, they’re not a get-rich-quick scheme, as they typically come in relatively small amounts. But on the bright side, all your earnings are deposited directly into your crypto wallet, giving it a minor boost.

How Do Crypto Faucets Work?

Crypto faucets typically function as a marketing tool for new cryptocurrencies. They incentivize new users to learn about revolutionary digital currencies and participate in the wider cryptocurrency community.

The functionality of crypto faucets is based on finishing simple tasks or participating in established activities. In most cases, the facilitators may fix the reward to a specific amount and set a timelock for participants to claim the rewards.

To participate and earn free crypto assets, you must register on a crypto faucet app or website by entering your details and wallet address. This allows you to participate in various tasks and challenges and have your reward deposited directly into your crypto wallet.

How To Choose the Right Crypto Faucet

Nothing hurts quite like wasting your time and energy on a promising endeavor only to end up with nothing to show. Therefore, it is essential to consider a few factors to increase your chances of getting a legitimate faucet. In that regard, here are a few factors to consider when choosing the right crypto faucet.

- Reputation and Trustworthiness

One crucial consideration to factor in is the faucet’s track record. And you can do this by validating its trustworthiness and reputation through online reviews. Some of the best faucets have a track record of paying out rewards promptly and reliably.

- User Experience

It might sound farfetched, but a faucet’s user experience is crucial in determining how easy it is to access rewards and payouts. For the best results, you should choose a faucet that provides a smooth, intuitive experience and with clear guides and helpful instructions.

- Rewards and Payout Rates

Crypto faucets aren’t made equal. Some websites and apps offer higher rewards with longer payout times and stringent requirements. Conversely, some faucets may offer lower rewards with quicker payouts and less strict requirements. Your choice depends on how much you want to earn and how long you will wait.

The Bottom Line

Cryptocurrency faucets offer the easiest way to earn free crypto assets. While some of these tasks may seem petty, getting the free coins is worth the effort. However, you should do your due diligence to ensure you choose the right faucet with rewards that match the effort.

Finance

Neobank vs Traditional Bank: Key Differences Explained

The world of financial services looks totally different now than it did just a few years ago. People want quick, smooth digital experiences, such as signing up in minutes, transparent pricing, and apps that actually help them manage their money.

This shift has given rise to neobank development. These digital-only banks are made to operate entirely online, without traditional branches and dusty paperwork.

Traditional banks still rely on old systems built decades ago. Sure, they cover a lot of financial services and strong regulatory foundations, but upgrading their infrastructure is a slow and time-consuming process, making it challenging to keep up with digital innovation.

According to a recent report, the global neobank market is expected to grow at a compound annual growth rate (CAGR) exceeding 45% through 2030, as most people are moving to digital systems and consumer preference for mobile banking.

Why are Neobanks in Demand?

Neobanks are booming because they move fast and put users first. People are embracing it in their regular lifestyle for a bunch of reasons:

- For opening an account right from your phone: no lines or any paperwork.

- The whole setup is optimized for mobile, so effortlessly use it anywhere, anytime.

- It comes with reduced operational costs with lower fees, and more transparency for users.

- Users can utilize the built-in tools for budgeting and tracking spending.

As millennials and Gen Z are switching to digital banks and are gradually moving away from traditional banking methods, this trend continues to accelerate.

Key Differences: Neobank vs Traditional Digital Bank

To understand this shift better, let’s check out the key differences between Neobank and traditional digital banks – how both models differ from technology to cost.

Architecture: Legacy Core vs Modular

The fundamental difference begins at the architecture level.

- Traditional banking software still relies on and runs on monolithic core systems. They are stable but very rigid when it comes to upgrades. It takes lots of time to change simple things, and adding new features is expensive.

- Neobank development has a different approach for building Neobank apps, leveraging a modular, API-first strategy. It’s all cloud-native, built with microservices and plenty of plug-and-play integrations. Within no time, it updates the system with the latest trends and functionalities from payment tools to ID check, without rebuilding the platform from scratch.

Speed to Market: Years vs Months

The development timelines are another major contrast.

- Legacy banking software can drag on for years, due to its risk controls, compliance reviews, and deep backend integrations

- Neobank app development leverages cloud infrastructure and partnerships with fintech providers, so they can go live in a matter of months. This development speed helps in creating a competitive edge to meet the customers’ expectations and technology trends.

Customer Experience: Experience-Driven vs Process-Driven

This shows how each model approaches user experience

- Traditional digital banks have their systems built around internal processes. This results in a lengthy process of endless steps, screens, and forms that probably make no sense. It’s like navigating their back office to complete a need.

- Neobanks have an entirely experience-driven approach to place the user experience at the core of everything, focusing on improving engagement and retention, especially among tech-savvy users.

- Opening an account is quick and simple.

- Users receive real-time notifications

- Navigation is made easy with intuitive dashboards

- AI-powered recommendations for financial insights

Scalability and Innovation

With the evolving financial ecosystem, scalability becomes crucial.

- Traditional digital banking methods are still stuck with proprietary languages to outdated frameworks, which are too costly and slow to scale.

- Neobank development leverages the latest methods, such as cloud scalability and continuous deployment. It allows them to roll out new features fast, with barely any downtime or big overhauls.

Cost Structure and Maintenance

This shows how infrastructure decisions directly impact long-term costs.

- Traditional banking software comes with a huge price tag, such as paying for licenses, running data centers, hiring specialized staff, etc.

- Neobanks reduce all types of overhead by using cloud-based services, subscription APIs, and modular vendors, which directly lowers the upfront investment and ongoing maintenance.

Final Thoughts:

Traditional digital banks have always focused on stability, meeting regulations, and protecting customer assets. It ensures reliability but slows down the innovation. As customers are expecting more personalized services with the latest technologies, traditional banks are facing increasing pressure to modernize with new advancements.

Neobanks, on the other hand, are moving fast, prioritizing agility, scaling, and creating a smooth user experience with built-in cloud native, API-driven architectures, and AI-powered tools. As more people are making the switch to Neobanks, businesses are increasingly seeking platforms that keep up with new trends and innovation but still stay secure and compliant.

If you are a fintech founder or running a business, you need solutions that grow with your customers, leverage the latest Neobank development technologies, and get rapid expansion in today’s digital economy.

Finance

Installment Loan Tips to Avoid Overpaying on Interest

Interest costs often determine whether a borrowing decision feels manageable or stressful over time. Clear preparation and careful review can limit unnecessary expenses before repayment begins. Small choices made early often affect the total amount repaid later across the full term. This guide explains practical steps that help reduce interest impact and support better financial outcomes.

Review the Total Cost Before Acceptance

Careful review should begin before any agreement moves forward or documents receive approval. Installment loans online often show monthly payments clearly, yet the total repayment amount deserves equal attention during review. Interest charges add up across the full term, even when individual payments appear modest. Reading disclosures helps reveal the full cost tied to the agreement.

Total cost includes more than interest alone in many cases. Origination charges, service fees, or administrative costs may apply at the start. These amounts increase the effective rate paid across the loan term. Awareness of each charge supports informed decision making.

Choose Shorter Terms When Possible

Loan length plays a major role in how much interest accumulates over time and affects the final cost. Shorter terms reduce the window during which continues to add expense to the balance. Monthly payments may rise slightly under shorter schedules, yet total repayment often falls by a noticeable margin. Balancing term length with budget comfort remains important to avoid payment strain.

Longer terms spread payments across many months and extend the repayment timeline. This approach lowers immediate payment size but raises total interest paid across the full period. Careful comparison helps clarify these tradeoffs in clear terms before acceptance. Planning ahead supports better cost control and steadier financial outcomes.

Check the Interest Rate Structure

Rate structure affects payment consistency and cost predictability. Fixed rates keep payments stable across the entire repayment schedule. Variable rates may shift based on market factors or policy changes. Understanding structure supports planning and budgeting.

Rates also differ based on credit profile, repayment history, and lender guidelines used during review. Even small rate changes affect long term totals and overall repayment cost. Comparing offers across multiple sources helps identify better value options. Preparation aids clarity during selection and supports more confident financial decisions.

Make Extra Payments When Allowed

Extra payments help reduce principal faster than scheduled. Lower balances lead to less interest charged over time. Checking agreement terms confirms whether early payments carry fees. Permission supports added flexibility.

Ways Extra Payments May Help

Extra payments often:

- Reduce total interest paid across the term.

- Shorten the overall repayment period.

- Improve cost efficiency of borrowing.

- Provide faster balance reduction.

Consistency matters more than payment size. Planning supports discipline.

Avoid Missed or Late Payments

Late payments often trigger added fees and create higher impact across the repayment period. Staying on schedule protects credit standing and helps keep overall costs lower. Automatic payment setup helps maintain consistency across due dates and reduces oversight risk. Timely payment supports steady progress and financial stability.

Missed payments may also affect future borrowing terms and approval outcomes. Penalties raise total cost quickly and place strain on monthly budgets. Awareness encourages careful planning around due dates and payment timing. Reliability supports savings and long term financial health.

Check the Offers Carefully

Offer comparison highlights differences that directly affect total repayment over the life of the agreement. Rates, fees, term length, and repayment structure vary widely among lenders and products. Reviewing multiple options side by side supports better informed choices and clearer expectations. Transparency in disclosures aids understanding of how costs add up over time.

Monthly payment amounts alone do not reflect the full cost of borrowing. Total repayment, added fees, and interest accumulation deserve close attention during review. Preparation helps avoid surprises that appear later in the schedule. Careful comparison strengthens confidence and supports sound financial decisions.

How Amortization Works

Amortization affects how each payment applies over time and shapes the pace of balance reduction. Early payments include a larger portion of interest compared to principal, which slows initial progress. As the balance declines, later payments shift more heavily toward principal reduction. Awareness of this pattern helps set realistic expectations across the repayment period.

Knowledge of this structure supports strategic use of extra payments when permitted. Targeted payments applied early can reduce interest exposure more quickly. Planned adjustments improve efficiency without altering the original schedule. Clear understanding supports control over total cost and repayment progress.

Interest costs depend heavily on preparation, term choice, and payment habits maintained over time. Installment loans online can remain manageable when attention stays on total cost rather than monthly figures alone. Clear review of terms, disciplined payment schedules, and thoughtful planning help reduce unnecessary expenses. Consistent awareness of how interest builds supports stronger control and more predictable outcomes.

Finance

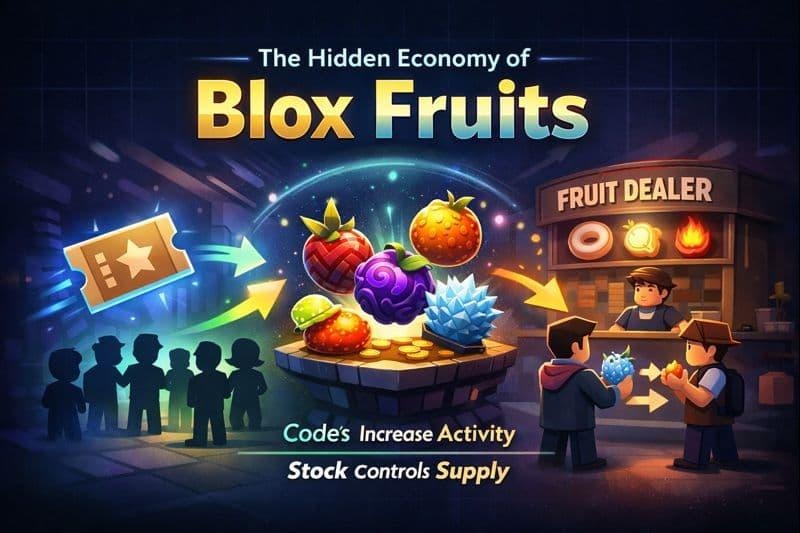

The Hidden Economy of Blox Fruits Codes Stocks and Trade Value Together

When you spend enough time inside Blox Fruits, you slowly realise that the game is not only about grinding or fighting bosses. There is a silent economy running in the background. Most players do not notice it clearly. The thing is very clear here. Codes, shop stock, and trade values are not isolated systems. They move together and affect each other all the time.

Many players treat these parts as separate. Codes feel like free rewards. Stock feels like a waiting game. Trading feels like luck. Once you connect these systems, the entire game starts feeling more logical and less confusing.

Understanding the Economic Layer Inside Blox Fruits

Blox Fruits does not show you charts or numbers like real markets. Still, the behavior feels very similar. Demand rises and falls. Supply changes with time. The player’s mindset decides value.

This economy mainly depends on three connected parts.

- Codes that increase activity and progression speed

- Fruit dealer stock that controls availability

- Trading values shaped by player demand and belief

When one part moves, the others react. That reaction is what creates value shifts.

How Codes Act Like Market Energy

Codes in Blox Fruits usually give EXP boosts or stat resets. On the surface, this looks harmless. The point is simple here. Codes push many players to level up faster at the same time.

When large numbers of players redeem codes together, a few things start happening.

- More players reach higher levels faster

- More players enter trading earlier than usual

- Demand for strong fruits increases suddenly

This demand increase happens without adding new fruits into circulation. That imbalance slowly changes trading behavior.

After major code releases, players usually want fruits that help grinding or PvP. This is why value movement feels sudden during these periods.

Fruit Dealer Stock Controls Scarcity

The fruit dealer stock decides which fruits feel common and which feel rare at any given time. Even a powerful fruit feels ordinary when it appears in stock repeatedly.

When a high demand fruit shows up in stock, the market reacts quickly.

- New players buy the fruit directly

- Traders expect short term value drops

- Trading activity slows for that fruit

Once the stock rotates out, scarcity returns. Players who waited benefit the most.

Codes indirectly affect this system too. Faster progression means more players checking stock often, which increases buying pressure during good rotations.

Trading Values Are Built by Players

Trading values in Blox Fruits are not fixed by the game. They are decided by players through shared belief and demand.

A fruit feels valuable when players believe it is valuable.

That belief usually comes from a mix of factors.

- How useful the fruit feels in grinding or PvP

- How recently the fruit appeared in stock

- How many players are actively searching for it

This is where many blox fruits trade and value calculators naturally come into the picture. Players want reference points to avoid bad trades. These tools do not control value. They reflect what the community thinks at that moment.

When stock or code activity changes, calculator values also shift. Nothing stays static.

The Loop That Keeps the Economy Alive

The hidden economy works in a repeating cycle.

- Codes increase player activity

- Higher activity increases fruit demand

- Stock controls which fruits stay scarce

- Scarcity shifts trading values

- Trading behavior reinforces demand

After that, the cycle repeats. This loop explains why sudden value spikes or drops feel confusing when you look at only one system.

Why New Players Struggle With Trading

New players usually enter trading without understanding this loop. A trade feels unfair because the context is missing.

Common mistakes new players make include.

- Ignoring recent stock rotations

- Trading right after major code drops

- Relying only on rarity instead of demand

Once you start watching patterns instead of individual trades, confidence improves.

How Long Term Players Stay Ahead

Experienced players usually follow quiet strategies.

- They trade after stock rotations end

- They wait during heavy code activity

- They store fruits during temporary demand drops

This approach is not about luck. It is about timing and patience.

External Rewards Also Influence the Economy

Player entry into the game also affects demand. Many players join after earning rewards outside the game.

Some players enter Blox Fruits after using Play store codes to redeem from reward apps or promotions. This increases new player activity in early seas. Early demand rises. Entry level fruits gain short term value.

Small changes become big when player numbers grow.

Final Thoughts on the Hidden Economy

Blox Fruits feels deeper once you stop viewing systems separately. Codes, stock, and trading values are connected gears. When one turns, the others move.

Understanding this ecosystem reduces frustration and improves decision making. Trades feel planned instead of risky. Progress feels earned instead of random.

-

Finance3 years ago

Finance3 years agoProfitable Intraday Trading Advice For Novices

-

Gaming2 years ago

Gaming2 years agoPixel Speedrun Unblocked Games 66

-

Gaming3 years ago

Gaming3 years agoSubway Surfers Unblocked | Subway Surfers Unblocked 66

-

Internet3 years ago

Internet3 years agoWelcome to banghechoigame.vn – Your One-Stop Destination for Online Gaming Fun!

-

Gaming3 years ago

Gaming3 years agoMinecraft Unblocked Games 66 | Unblocked Games Minecraft

-

Gaming3 years ago

Gaming3 years agoGoogle Baseball Unblocked | Google Doodle Baseball Unblocked 66

-

Internet3 years ago

Internet3 years agoPremium Games Unblocked: Unleash Your Gaming Potential

-

Gaming3 years ago

Gaming3 years agoTunnel Rush Unblocked | Tunnel Rush Unblocked 66