Finance

Empower Yourself: A Step-By-Step Guide On How To Start A Tax Preparation Business

Dive into the intricacies of tax preparation. Our guide provides a clear path to How to start a tax preparation business. Empower yourself with the skills and knowledge you need to succeed.

Starting your own business can be daunting, but with the right strategy and mindset, it can also be incredibly empowering. One business venture that is always in demand is tax preparation.

With tax laws always changing and individuals and businesses always needing help, starting your tax preparation business can be a smart move, both financially and personally.

In this guide, we’ll lay out a step-by-step plan to help you start your own tax preparation business and empower yourself to succeed.

Step 1: Understand The Business

The first step is to understand the business of tax preparation. It includes learning about the process of tax preparation, tax laws, and government regulations.

You should also research the competition in your area to gauge demand and see what Financial Service they offer.

By doing your market research, you will clearly understand the industry and what is required to succeed.

Step 2: Get The Right Education And Credentials

Education and credentials are essential if you want to run your own tax preparation business successfully. You need to understand tax laws, tax preparation software, and the tax code to be effective.

Some options for getting the right education and credentials include attending tax preparation courses, pursuing a degree in accounting or finance, and becoming an enrolled agent by passing the IRS Special Enrollment Examination.

Step 3: Choose Your Business Model

Once you have the education and credentials you need, the next step is to choose your business model. You can start your own tax preparation business as a sole proprietorship, partnership, or corporation.

Each has its advantages and disadvantages, so research them all and choose the one that best fits your needs.

Step 4: Develop Your Business Plan

With your business model in mind, you should develop your business plan. Your plan should include your target market, pricing strategy, marketing plan, legal structure, and financial projections.

By creating a comprehensive business plan, you will have a clear roadmap for starting and running your business.

Step 5: Get Licensed And Registered

Before starting your tax preparation business, you need to get licensed and registered.

It includes obtaining a tax identification number, registering your business with the state, and obtaining any necessary business licenses and permits.

By completing this step, you will have the legal foundation needed to operate your business and start serving clients yourself to succeed.

Step 6: Invest In The Right Tools And Technology

The right tools and technology are critical for a successful tax preparation business. It includes investing in reliable tax preparation software, computer equipment, and other necessary office supplies.

By having the right tools at your disposal, you can efficiently serve your clients and stay organized.

Step 7: Build Your Brand

You need to build your brand to stand out in a competitive industry. It includes creating a professional website, designing a memorable logo and business card, and establishing an online presence through social media platforms.

A strong brand will help attract new clients and create a sense of trust and credibility with potential customers.

Step 8: Develop Relationships With Clients

Building relationships with your clients is crucial for a successful tax preparation business. It includes providing excellent customer service, maintaining clear communication, and offering personalized services that meet their individual needs.

By developing strong relationships with your clients, you will retain them as customers and gain referrals through word of mouth.

Step 9: Market Your Business

Marketing is an essential aspect of any business, including a tax preparation business. You need to inform potential clients about your services and why they should choose you over competitors.

Some effective marketing strategies include networking with other professionals, offering promotions or discounts, and advertising through various platforms such as print, online, or social media.

Step 10: Stay Up-To-Date On Tax Laws

Lastly, staying up-to-date on tax laws is crucial for maintaining the success of your tax preparation business. Tax laws and regulations are constantly changing, so staying informed and adapting is important.

It can include attending seminars or workshops, joining professional associations, and regularly reading up on industry news.

Conclusion

Starting a tax preparation business can be both financially and personally rewarding. By following these steps, you will have the knowledge, skills, and resources How to start a tax business.

Remember to stay informed, continuously educate yourself, and constantly adapt to the ever-changing tax laws and regulations landscape.

With dedication and hard work, you can empower yourself to build a successful tax preparation business that serves your clients well and brings you professional fulfillment.

So go ahead, take the leap, and start your journey toward entrepreneurship today with Keystone Tax Solutions!

Finance

Installment Loan Tips to Avoid Overpaying on Interest

Interest costs often determine whether a borrowing decision feels manageable or stressful over time. Clear preparation and careful review can limit unnecessary expenses before repayment begins. Small choices made early often affect the total amount repaid later across the full term. This guide explains practical steps that help reduce interest impact and support better financial outcomes.

Review the Total Cost Before Acceptance

Careful review should begin before any agreement moves forward or documents receive approval. Installment loans online often show monthly payments clearly, yet the total repayment amount deserves equal attention during review. Interest charges add up across the full term, even when individual payments appear modest. Reading disclosures helps reveal the full cost tied to the agreement.

Total cost includes more than interest alone in many cases. Origination charges, service fees, or administrative costs may apply at the start. These amounts increase the effective rate paid across the loan term. Awareness of each charge supports informed decision making.

Choose Shorter Terms When Possible

Loan length plays a major role in how much interest accumulates over time and affects the final cost. Shorter terms reduce the window during which continues to add expense to the balance. Monthly payments may rise slightly under shorter schedules, yet total repayment often falls by a noticeable margin. Balancing term length with budget comfort remains important to avoid payment strain.

Longer terms spread payments across many months and extend the repayment timeline. This approach lowers immediate payment size but raises total interest paid across the full period. Careful comparison helps clarify these tradeoffs in clear terms before acceptance. Planning ahead supports better cost control and steadier financial outcomes.

Check the Interest Rate Structure

Rate structure affects payment consistency and cost predictability. Fixed rates keep payments stable across the entire repayment schedule. Variable rates may shift based on market factors or policy changes. Understanding structure supports planning and budgeting.

Rates also differ based on credit profile, repayment history, and lender guidelines used during review. Even small rate changes affect long term totals and overall repayment cost. Comparing offers across multiple sources helps identify better value options. Preparation aids clarity during selection and supports more confident financial decisions.

Make Extra Payments When Allowed

Extra payments help reduce principal faster than scheduled. Lower balances lead to less interest charged over time. Checking agreement terms confirms whether early payments carry fees. Permission supports added flexibility.

Ways Extra Payments May Help

Extra payments often:

- Reduce total interest paid across the term.

- Shorten the overall repayment period.

- Improve cost efficiency of borrowing.

- Provide faster balance reduction.

Consistency matters more than payment size. Planning supports discipline.

Avoid Missed or Late Payments

Late payments often trigger added fees and create higher impact across the repayment period. Staying on schedule protects credit standing and helps keep overall costs lower. Automatic payment setup helps maintain consistency across due dates and reduces oversight risk. Timely payment supports steady progress and financial stability.

Missed payments may also affect future borrowing terms and approval outcomes. Penalties raise total cost quickly and place strain on monthly budgets. Awareness encourages careful planning around due dates and payment timing. Reliability supports savings and long term financial health.

Check the Offers Carefully

Offer comparison highlights differences that directly affect total repayment over the life of the agreement. Rates, fees, term length, and repayment structure vary widely among lenders and products. Reviewing multiple options side by side supports better informed choices and clearer expectations. Transparency in disclosures aids understanding of how costs add up over time.

Monthly payment amounts alone do not reflect the full cost of borrowing. Total repayment, added fees, and interest accumulation deserve close attention during review. Preparation helps avoid surprises that appear later in the schedule. Careful comparison strengthens confidence and supports sound financial decisions.

How Amortization Works

Amortization affects how each payment applies over time and shapes the pace of balance reduction. Early payments include a larger portion of interest compared to principal, which slows initial progress. As the balance declines, later payments shift more heavily toward principal reduction. Awareness of this pattern helps set realistic expectations across the repayment period.

Knowledge of this structure supports strategic use of extra payments when permitted. Targeted payments applied early can reduce interest exposure more quickly. Planned adjustments improve efficiency without altering the original schedule. Clear understanding supports control over total cost and repayment progress.

Interest costs depend heavily on preparation, term choice, and payment habits maintained over time. Installment loans online can remain manageable when attention stays on total cost rather than monthly figures alone. Clear review of terms, disciplined payment schedules, and thoughtful planning help reduce unnecessary expenses. Consistent awareness of how interest builds supports stronger control and more predictable outcomes.

Finance

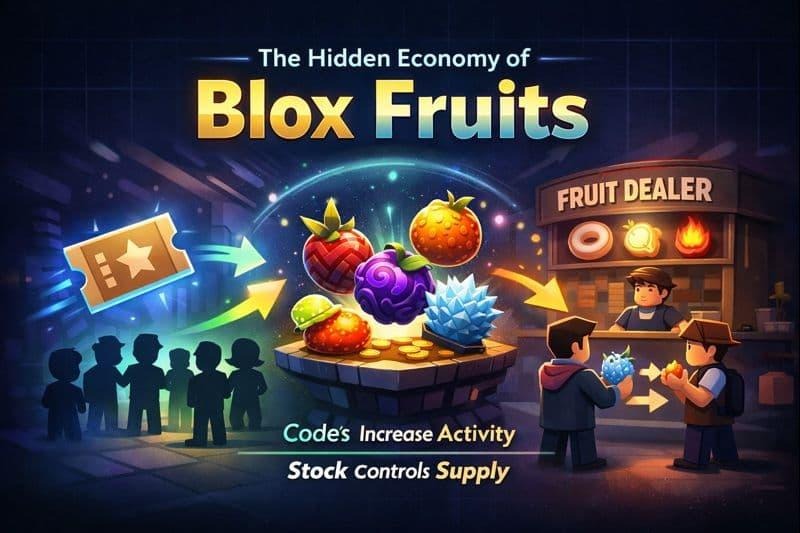

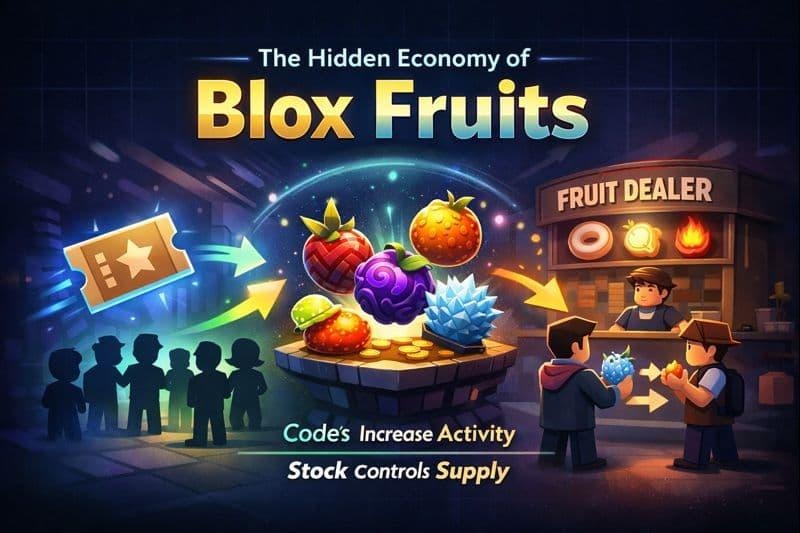

The Hidden Economy of Blox Fruits Codes Stocks and Trade Value Together

When you spend enough time inside Blox Fruits, you slowly realise that the game is not only about grinding or fighting bosses. There is a silent economy running in the background. Most players do not notice it clearly. The thing is very clear here. Codes, shop stock, and trade values are not isolated systems. They move together and affect each other all the time.

Many players treat these parts as separate. Codes feel like free rewards. Stock feels like a waiting game. Trading feels like luck. Once you connect these systems, the entire game starts feeling more logical and less confusing.

Understanding the Economic Layer Inside Blox Fruits

Blox Fruits does not show you charts or numbers like real markets. Still, the behavior feels very similar. Demand rises and falls. Supply changes with time. The player’s mindset decides value.

This economy mainly depends on three connected parts.

- Codes that increase activity and progression speed

- Fruit dealer stock that controls availability

- Trading values shaped by player demand and belief

When one part moves, the others react. That reaction is what creates value shifts.

How Codes Act Like Market Energy

Codes in Blox Fruits usually give EXP boosts or stat resets. On the surface, this looks harmless. The point is simple here. Codes push many players to level up faster at the same time.

When large numbers of players redeem codes together, a few things start happening.

- More players reach higher levels faster

- More players enter trading earlier than usual

- Demand for strong fruits increases suddenly

This demand increase happens without adding new fruits into circulation. That imbalance slowly changes trading behavior.

After major code releases, players usually want fruits that help grinding or PvP. This is why value movement feels sudden during these periods.

Fruit Dealer Stock Controls Scarcity

The fruit dealer stock decides which fruits feel common and which feel rare at any given time. Even a powerful fruit feels ordinary when it appears in stock repeatedly.

When a high demand fruit shows up in stock, the market reacts quickly.

- New players buy the fruit directly

- Traders expect short term value drops

- Trading activity slows for that fruit

Once the stock rotates out, scarcity returns. Players who waited benefit the most.

Codes indirectly affect this system too. Faster progression means more players checking stock often, which increases buying pressure during good rotations.

Trading Values Are Built by Players

Trading values in Blox Fruits are not fixed by the game. They are decided by players through shared belief and demand.

A fruit feels valuable when players believe it is valuable.

That belief usually comes from a mix of factors.

- How useful the fruit feels in grinding or PvP

- How recently the fruit appeared in stock

- How many players are actively searching for it

This is where many blox fruits trade and value calculators naturally come into the picture. Players want reference points to avoid bad trades. These tools do not control value. They reflect what the community thinks at that moment.

When stock or code activity changes, calculator values also shift. Nothing stays static.

The Loop That Keeps the Economy Alive

The hidden economy works in a repeating cycle.

- Codes increase player activity

- Higher activity increases fruit demand

- Stock controls which fruits stay scarce

- Scarcity shifts trading values

- Trading behavior reinforces demand

After that, the cycle repeats. This loop explains why sudden value spikes or drops feel confusing when you look at only one system.

Why New Players Struggle With Trading

New players usually enter trading without understanding this loop. A trade feels unfair because the context is missing.

Common mistakes new players make include.

- Ignoring recent stock rotations

- Trading right after major code drops

- Relying only on rarity instead of demand

Once you start watching patterns instead of individual trades, confidence improves.

How Long Term Players Stay Ahead

Experienced players usually follow quiet strategies.

- They trade after stock rotations end

- They wait during heavy code activity

- They store fruits during temporary demand drops

This approach is not about luck. It is about timing and patience.

External Rewards Also Influence the Economy

Player entry into the game also affects demand. Many players join after earning rewards outside the game.

Some players enter Blox Fruits after using Play store codes to redeem from reward apps or promotions. This increases new player activity in early seas. Early demand rises. Entry level fruits gain short term value.

Small changes become big when player numbers grow.

Final Thoughts on the Hidden Economy

Blox Fruits feels deeper once you stop viewing systems separately. Codes, stock, and trading values are connected gears. When one turns, the others move.

Understanding this ecosystem reduces frustration and improves decision making. Trades feel planned instead of risky. Progress feels earned instead of random.

Finance

The Importance of Data Analysis Insights Shared on 파토커뮤니티

In today’s digital age, information is no longer merely a source of power; rather, information is considered the currency of success. Anyone related to businesses, be it professionals, is constantly in search of authentic information that helps in making informed decisions. This is where platforms like 파토커뮤니티 step in as a key decision-support mechanism for those desiring success in today’s ever-changing digital world.

Why Data Analysis Matters Today

Data analysis is no longer a luxury but a required element. Every business decision, marketing decision, and personal development decision involves interpreting data. Correct interpretation can lead to the identification of trends and may indicate opportunities that could be overlooked. Decisions are often made on assumptions and may be made on incomplete information when the insights are not available.

Platforms like 파토커뮤니티 allow users to access diverse pieces of knowledge and insight collated through the members of the community. In communities such as 파토 커뮤니티, knowledge collation is not a matter of personal opinion but rather data culled from experiences and expertise in various fields from different individuals. This makes the knowledge base richer and more reliable for anyone approaching it.

Benefits of Sharing Insights about 파토커뮤니티

- Enhanced Decision-Making

The use of platforms such as 파토커뮤니티 offers a number of major benefits, improving decision-making. In this way, users can observe the trend of data, strategies comparisons, or even the forecast of results based on information given by the community. For instance, a person looking for investment opportunities or online marketing may look at information from previous members based on data shared.

- Collaboration and networking opportunities

파토 커뮤니티is more than just data. It is people. The idea to share knowledge stimulates collaboration. It enables people to connect with other professionals in other fields. This is where collaboration may lead to new innovative thoughts that, through isolation, it seems impossible to attain. PaTo Community is people-centered, ensuring that knowledge is derived from real-life experiences and not from simulated situations.

- Problem Solving & Strategy Formulation

Each profession develops its own set of challenges, be it process optimization, resource management, or analyzing market dynamics. Members on 파토커뮤니티 regularly share case studies, methods, and approaches which have helped them solve a similar problem. Real-life experiences are always more precious compared to advice that is purely theoretical.

- Current Information and Trends

The Internet is a world that keeps on changing. The need to catch up with every minute evolution makes it crucial, and the 파토 커뮤니티 ensures this by letting its consumers spread the latest trends, reports, and discovery information available so that all members can communicate with the latest information coming. This news can be a game changer for entrepreneurs whose data becomes stale tomorrow.

How 파토 커뮤니티 Ensures Reliable Insights

One issue that online platforms for data sharing may present is the issue of credibility. The information that users of such platforms may be exposed to may be inaccurate or influenced by a certain point of view that may be misleading. 파토커뮤니티 solves this problem of credibility by providing moderated platforms, references from experts, and discussion forums.

Moreover, the 파토 커뮤니티 community fosters knowledge building among users, who are encouraged to provide an explanation for the information that they are posting. Users are not restricted to posting figures without providing background information about methodology, the source of the information, as well as the implications of the findings.

Practical Applications of Insights from 파토커뮤니티

- Business Strategy and Marketing

Corporations can make use of information being disseminated on 파토커뮤니티 in order to be able to gauge market trends and behavior patterns of their customers and rivals. Such an approach is highly useful in designing campaigns and launching products.

- Investment and Financial Planning

For investors, having access to real-world data and being able to chat about market trends is a big influencer on decision-making. 파토 커뮤니티 contains information regarding investment strategy, risk, and financial analysis that enables informed and calculated decisions.

- Skill Development for Professionals

Besides business and finance, information on 파토커뮤니티 would enhance professional development: people can learn about new analytical techniques, the best practices which increase job prospects.

- Community Research and Learning

Investigators, as well as students, will find beneficial the deep well of information available through 파토 커뮤니티. This is a communal resource that allows access to several points of view, cases, and data that can be used to supplement research.

Encouraging Active Participation

When The success of 파토커뮤니티 relies on participation. The more one participates, the more pool of knowledge one will be exposed to. The participation makes 파토커뮤니티 successful. Participation not only benefits the person as an individual but helps to build a stronger network as a whole. Posting of exclusive knowledge, commenting, and questioning falls under a collaborative learning process.

Furthermore, active involvement may add to the community credibility. Those users who regularly and accurately take part in the community will be recognized, and this recognition may add to professional networking.

Conclusion

In today’s information age, having access to platforms such as 파토커뮤니티 or 파토 커뮤니티 is nothing short of gold. They not only provide information, but they provide a community where information can be shared, tested, and then activated to improve decision-making capabilities. The list goes on with respect to using 파토커뮤니티 to improve business decision making or personal development.

Through the promotion of transparency, collaboration, and participation, 파토 커뮤니티.com ensures not only the availability of information to the user but also the skills needed to decode and apply the information. For any individual looking for credible and applicable insights, membership in 파토 커뮤니티 really represents the first step toward making smarter decisions.

-

Finance3 years ago

Finance3 years agoProfitable Intraday Trading Advice For Novices

-

Gaming2 years ago

Gaming2 years agoPixel Speedrun Unblocked Games 66

-

Gaming3 years ago

Gaming3 years agoSubway Surfers Unblocked | Subway Surfers Unblocked 66

-

Internet3 years ago

Internet3 years agoWelcome to banghechoigame.vn – Your One-Stop Destination for Online Gaming Fun!

-

Gaming3 years ago

Gaming3 years agoMinecraft Unblocked Games 66 | Unblocked Games Minecraft

-

Gaming3 years ago

Gaming3 years agoGoogle Baseball Unblocked | Google Doodle Baseball Unblocked 66

-

Internet3 years ago

Internet3 years agoPremium Games Unblocked: Unleash Your Gaming Potential

-

Gaming3 years ago

Gaming3 years agoTunnel Rush Unblocked | Tunnel Rush Unblocked 66