Finance

Electric Car Insurance in India: Is It Different From Regular Car Insurance?

With the rising demand for eco-friendly alternatives, electric vehicles (EVs) are becoming increasingly popular among Indian car buyers. Whether it’s the promise of a cleaner environment or government incentives, EVs have carved out a promising space on Indian roads. However, a common question that arises with the rise of EVs is about car insurance, specifically, how electric car insurance differs from regular car insurance.

Suppose you’re planning to make the switch or have recently bought a new electric vehicle. In that case, it’s essential to understand how new car insurance for EVs works, what it covers, and how you can buy car insurance online that is suited to your electric 4-wheeler.

What is Electric Car Insurance?

Electric car insurance in India provides financial protection to EV owners against damages, theft, third-party liabilities, and personal accidents. It works similarly to regular 4 wheeler insurance but also considers certain unique aspects of electric vehicles, such as the battery, charging infrastructure, and fewer moving parts.

There are two types of electric car insurance in India:

- Third-Party Insurance is mandatory as per Indian law. It covers damage to third parties (person or property) but not your vehicle.

Comprehensive Insurance offers extensive protection, including own damage (OD), third-party liabilities, theft, natural calamities, fire, and more.

How Is Electric Car Insurance Different from Regular Car Insurance?

While the structure of the policy remains similar, there are several ways in which electric car insurance differs from conventional internal combustion engine (ICE) car insurance:

1. Premium Calculation

Premiums for EVs are typically lower than for ICE vehicles. The Insurance Regulatory and Development Authority of India (IRDAI) has mandated discounts on third-party premiums for electric cars to encourage their adoption. However, the comprehensive premium may be higher due to the expensive battery system, which is one of the costliest components to replace.

2. Coverage for the Battery

Unlike petrol or diesel cars, EVs rely heavily on their battery system. The insurance policy for an electric vehicle must include coverage for battery-related issues. Bajaj Allianz, for instance, offers policies that specifically include protection for the battery in addition to standard coverages.

3. Charging Equipment

Some online vehicle insurance providers are beginning to offer optional add-ons for covering EV charging cables and domestic charging stations, something not needed in regular car insurance.

4. Depreciation and Repairs

The repair and replacement costs for electric cars, especially for the battery and electronic components, are generally higher than those of traditional vehicles. Hence, having zero-depreciation add-ons or consumables cover becomes even more critical in online insurance for EVs.

5. Fewer Moving Parts = Lower Risk

EVs have fewer moving mechanical parts compared to ICE cars. This lowers the probability of some types of breakdowns, making them more durable in some ways. Over time, this could mean fewer claims, potentially leading to lower premiums in the future.

Why Buy Car Insurance Online for Electric Vehicles?

Digitisation has made it easier to buy car insurance online, compare policies, and access documents instantly. Opting for online insurance is not only quicker but also more transparent. You can easily compare features, premiums, and add-ons for plans explicitly tailored for EVs.

Insurers like Bajaj Allianz allow you to compare policies online, customise add-ons, and complete the entire purchase or renewal process in minutes. Additionally, their app and website support online vehicle insurance claims processing, policy tracking, and real-time support, making it a hassle-free experience for electric car owners.

Key Features to Look for in an Electric Car Insurance Policy

- Comprehensive Coverage: Always opt for a policy that covers own damage, third-party liabilities, theft, fire, floods, and man-made disasters.

- Battery Protection: Since the battery is central to your EV’s function and one of its most expensive parts, ensure your policy covers battery replacement and damage.

- Charging Station Coverage: Look for policies that provide protection for damage to or theft of home charging units.

- Roadside Assistance: Breakdown assistance is especially critical for EVs, considering range limitations and the lack of widespread charging infrastructure.

- Add-Ons: Choose suitable add-ons like zero depreciation, engine and gearbox protection (if applicable), key replacement, and more.

Premium Rates for Electric Car Insurance in India

The IRDAI has introduced lower premium rates for electric cars to promote green mobility. While these discounts apply to the third-party component, the overall premium for comprehensive insurance depends on:

- Cost of the EV

- Battery capacity (measured in kWh)

- Age and model of the car

- Add-ons and policy term

- City of registration

For example, the third-party premium for a private electric car not exceeding 30 kW is lower than that for its petrol or diesel counterpart.

Bajaj Allianz Electric Car Insurance

Bajaj Allianz is one of India’s top insurance providers, offering tailored solutions for electric cars. Their new car insurance plans are designed to accommodate the unique requirements of EVs. Key highlights include:

- Easy online policy issuance and renewal

- Battery and electrical components coverage

- 24/7 customer service and roadside assistance

- Customisable add-ons and affordable premiums

- App-based claims tracking and policy management

The Bajaj Allianz mobile app also helps users access their policy documents, request towing services, or register claims conveniently, making it a go-to option for many who want to buy car insurance online.

Tips to Buy the Right Electric Car Insurance

- Compare multiple insurers using aggregators or insurance portals.

- Use car insurance online check tools to verify the insurer’s coverage for EVs.

- Read policy wordings carefully to ensure battery and charging accessories are covered.

- Choose annual or long-term plans based on usage and savings on premiums.

- Ensure NCB (No Claim Bonus) is preserved at renewal for additional savings.

Conclusion

Electric car insurance in India is not fundamentally different from regular car insurance, but it does involve additional considerations unique to EV technology. From specialised coverage for batteries to optional protection for charging stations, the scope of coverage has evolved with the vehicle’s mechanics.

As the Indian automobile market shifts towards electric mobility, it’s crucial to pick the right 4 wheeler insurance policy that understands and addresses these differences. Reputed providers like Bajaj Allianz have already tailored their offerings for electric car owners, with seamless options to buy car insurance online.

Whether you’re purchasing your first EV or renewing your online vehicle insurance, ensure that the policy provides holistic coverage, matches your usage pattern, and is equipped for the future of mobility.

Finance

Installment Loan Tips to Avoid Overpaying on Interest

Interest costs often determine whether a borrowing decision feels manageable or stressful over time. Clear preparation and careful review can limit unnecessary expenses before repayment begins. Small choices made early often affect the total amount repaid later across the full term. This guide explains practical steps that help reduce interest impact and support better financial outcomes.

Review the Total Cost Before Acceptance

Careful review should begin before any agreement moves forward or documents receive approval. Installment loans online often show monthly payments clearly, yet the total repayment amount deserves equal attention during review. Interest charges add up across the full term, even when individual payments appear modest. Reading disclosures helps reveal the full cost tied to the agreement.

Total cost includes more than interest alone in many cases. Origination charges, service fees, or administrative costs may apply at the start. These amounts increase the effective rate paid across the loan term. Awareness of each charge supports informed decision making.

Choose Shorter Terms When Possible

Loan length plays a major role in how much interest accumulates over time and affects the final cost. Shorter terms reduce the window during which continues to add expense to the balance. Monthly payments may rise slightly under shorter schedules, yet total repayment often falls by a noticeable margin. Balancing term length with budget comfort remains important to avoid payment strain.

Longer terms spread payments across many months and extend the repayment timeline. This approach lowers immediate payment size but raises total interest paid across the full period. Careful comparison helps clarify these tradeoffs in clear terms before acceptance. Planning ahead supports better cost control and steadier financial outcomes.

Check the Interest Rate Structure

Rate structure affects payment consistency and cost predictability. Fixed rates keep payments stable across the entire repayment schedule. Variable rates may shift based on market factors or policy changes. Understanding structure supports planning and budgeting.

Rates also differ based on credit profile, repayment history, and lender guidelines used during review. Even small rate changes affect long term totals and overall repayment cost. Comparing offers across multiple sources helps identify better value options. Preparation aids clarity during selection and supports more confident financial decisions.

Make Extra Payments When Allowed

Extra payments help reduce principal faster than scheduled. Lower balances lead to less interest charged over time. Checking agreement terms confirms whether early payments carry fees. Permission supports added flexibility.

Ways Extra Payments May Help

Extra payments often:

- Reduce total interest paid across the term.

- Shorten the overall repayment period.

- Improve cost efficiency of borrowing.

- Provide faster balance reduction.

Consistency matters more than payment size. Planning supports discipline.

Avoid Missed or Late Payments

Late payments often trigger added fees and create higher impact across the repayment period. Staying on schedule protects credit standing and helps keep overall costs lower. Automatic payment setup helps maintain consistency across due dates and reduces oversight risk. Timely payment supports steady progress and financial stability.

Missed payments may also affect future borrowing terms and approval outcomes. Penalties raise total cost quickly and place strain on monthly budgets. Awareness encourages careful planning around due dates and payment timing. Reliability supports savings and long term financial health.

Check the Offers Carefully

Offer comparison highlights differences that directly affect total repayment over the life of the agreement. Rates, fees, term length, and repayment structure vary widely among lenders and products. Reviewing multiple options side by side supports better informed choices and clearer expectations. Transparency in disclosures aids understanding of how costs add up over time.

Monthly payment amounts alone do not reflect the full cost of borrowing. Total repayment, added fees, and interest accumulation deserve close attention during review. Preparation helps avoid surprises that appear later in the schedule. Careful comparison strengthens confidence and supports sound financial decisions.

How Amortization Works

Amortization affects how each payment applies over time and shapes the pace of balance reduction. Early payments include a larger portion of interest compared to principal, which slows initial progress. As the balance declines, later payments shift more heavily toward principal reduction. Awareness of this pattern helps set realistic expectations across the repayment period.

Knowledge of this structure supports strategic use of extra payments when permitted. Targeted payments applied early can reduce interest exposure more quickly. Planned adjustments improve efficiency without altering the original schedule. Clear understanding supports control over total cost and repayment progress.

Interest costs depend heavily on preparation, term choice, and payment habits maintained over time. Installment loans online can remain manageable when attention stays on total cost rather than monthly figures alone. Clear review of terms, disciplined payment schedules, and thoughtful planning help reduce unnecessary expenses. Consistent awareness of how interest builds supports stronger control and more predictable outcomes.

Finance

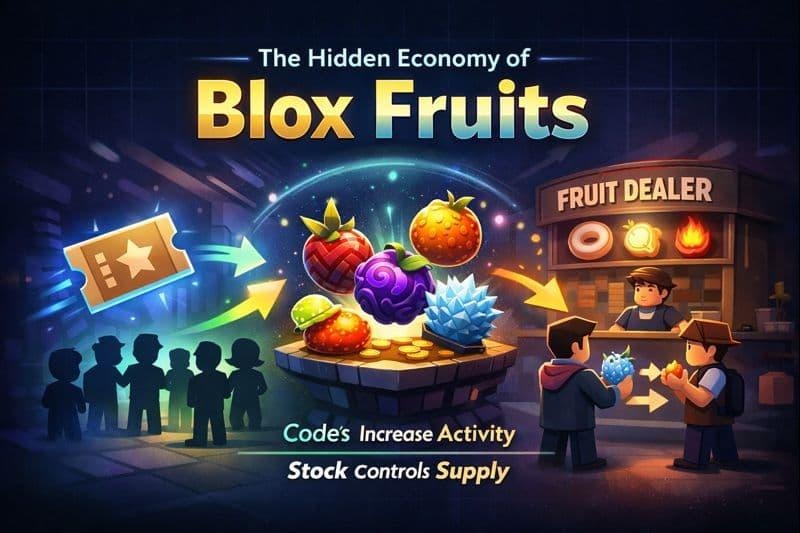

The Hidden Economy of Blox Fruits Codes Stocks and Trade Value Together

When you spend enough time inside Blox Fruits, you slowly realise that the game is not only about grinding or fighting bosses. There is a silent economy running in the background. Most players do not notice it clearly. The thing is very clear here. Codes, shop stock, and trade values are not isolated systems. They move together and affect each other all the time.

Many players treat these parts as separate. Codes feel like free rewards. Stock feels like a waiting game. Trading feels like luck. Once you connect these systems, the entire game starts feeling more logical and less confusing.

Understanding the Economic Layer Inside Blox Fruits

Blox Fruits does not show you charts or numbers like real markets. Still, the behavior feels very similar. Demand rises and falls. Supply changes with time. The player’s mindset decides value.

This economy mainly depends on three connected parts.

- Codes that increase activity and progression speed

- Fruit dealer stock that controls availability

- Trading values shaped by player demand and belief

When one part moves, the others react. That reaction is what creates value shifts.

How Codes Act Like Market Energy

Codes in Blox Fruits usually give EXP boosts or stat resets. On the surface, this looks harmless. The point is simple here. Codes push many players to level up faster at the same time.

When large numbers of players redeem codes together, a few things start happening.

- More players reach higher levels faster

- More players enter trading earlier than usual

- Demand for strong fruits increases suddenly

This demand increase happens without adding new fruits into circulation. That imbalance slowly changes trading behavior.

After major code releases, players usually want fruits that help grinding or PvP. This is why value movement feels sudden during these periods.

Fruit Dealer Stock Controls Scarcity

The fruit dealer stock decides which fruits feel common and which feel rare at any given time. Even a powerful fruit feels ordinary when it appears in stock repeatedly.

When a high demand fruit shows up in stock, the market reacts quickly.

- New players buy the fruit directly

- Traders expect short term value drops

- Trading activity slows for that fruit

Once the stock rotates out, scarcity returns. Players who waited benefit the most.

Codes indirectly affect this system too. Faster progression means more players checking stock often, which increases buying pressure during good rotations.

Trading Values Are Built by Players

Trading values in Blox Fruits are not fixed by the game. They are decided by players through shared belief and demand.

A fruit feels valuable when players believe it is valuable.

That belief usually comes from a mix of factors.

- How useful the fruit feels in grinding or PvP

- How recently the fruit appeared in stock

- How many players are actively searching for it

This is where many blox fruits trade and value calculators naturally come into the picture. Players want reference points to avoid bad trades. These tools do not control value. They reflect what the community thinks at that moment.

When stock or code activity changes, calculator values also shift. Nothing stays static.

The Loop That Keeps the Economy Alive

The hidden economy works in a repeating cycle.

- Codes increase player activity

- Higher activity increases fruit demand

- Stock controls which fruits stay scarce

- Scarcity shifts trading values

- Trading behavior reinforces demand

After that, the cycle repeats. This loop explains why sudden value spikes or drops feel confusing when you look at only one system.

Why New Players Struggle With Trading

New players usually enter trading without understanding this loop. A trade feels unfair because the context is missing.

Common mistakes new players make include.

- Ignoring recent stock rotations

- Trading right after major code drops

- Relying only on rarity instead of demand

Once you start watching patterns instead of individual trades, confidence improves.

How Long Term Players Stay Ahead

Experienced players usually follow quiet strategies.

- They trade after stock rotations end

- They wait during heavy code activity

- They store fruits during temporary demand drops

This approach is not about luck. It is about timing and patience.

External Rewards Also Influence the Economy

Player entry into the game also affects demand. Many players join after earning rewards outside the game.

Some players enter Blox Fruits after using Play store codes to redeem from reward apps or promotions. This increases new player activity in early seas. Early demand rises. Entry level fruits gain short term value.

Small changes become big when player numbers grow.

Final Thoughts on the Hidden Economy

Blox Fruits feels deeper once you stop viewing systems separately. Codes, stock, and trading values are connected gears. When one turns, the others move.

Understanding this ecosystem reduces frustration and improves decision making. Trades feel planned instead of risky. Progress feels earned instead of random.

Finance

The Importance of Data Analysis Insights Shared on 파토커뮤니티

In today’s digital age, information is no longer merely a source of power; rather, information is considered the currency of success. Anyone related to businesses, be it professionals, is constantly in search of authentic information that helps in making informed decisions. This is where platforms like 파토커뮤니티 step in as a key decision-support mechanism for those desiring success in today’s ever-changing digital world.

Why Data Analysis Matters Today

Data analysis is no longer a luxury but a required element. Every business decision, marketing decision, and personal development decision involves interpreting data. Correct interpretation can lead to the identification of trends and may indicate opportunities that could be overlooked. Decisions are often made on assumptions and may be made on incomplete information when the insights are not available.

Platforms like 파토커뮤니티 allow users to access diverse pieces of knowledge and insight collated through the members of the community. In communities such as 파토 커뮤니티, knowledge collation is not a matter of personal opinion but rather data culled from experiences and expertise in various fields from different individuals. This makes the knowledge base richer and more reliable for anyone approaching it.

Benefits of Sharing Insights about 파토커뮤니티

- Enhanced Decision-Making

The use of platforms such as 파토커뮤니티 offers a number of major benefits, improving decision-making. In this way, users can observe the trend of data, strategies comparisons, or even the forecast of results based on information given by the community. For instance, a person looking for investment opportunities or online marketing may look at information from previous members based on data shared.

- Collaboration and networking opportunities

파토 커뮤니티is more than just data. It is people. The idea to share knowledge stimulates collaboration. It enables people to connect with other professionals in other fields. This is where collaboration may lead to new innovative thoughts that, through isolation, it seems impossible to attain. PaTo Community is people-centered, ensuring that knowledge is derived from real-life experiences and not from simulated situations.

- Problem Solving & Strategy Formulation

Each profession develops its own set of challenges, be it process optimization, resource management, or analyzing market dynamics. Members on 파토커뮤니티 regularly share case studies, methods, and approaches which have helped them solve a similar problem. Real-life experiences are always more precious compared to advice that is purely theoretical.

- Current Information and Trends

The Internet is a world that keeps on changing. The need to catch up with every minute evolution makes it crucial, and the 파토 커뮤니티 ensures this by letting its consumers spread the latest trends, reports, and discovery information available so that all members can communicate with the latest information coming. This news can be a game changer for entrepreneurs whose data becomes stale tomorrow.

How 파토 커뮤니티 Ensures Reliable Insights

One issue that online platforms for data sharing may present is the issue of credibility. The information that users of such platforms may be exposed to may be inaccurate or influenced by a certain point of view that may be misleading. 파토커뮤니티 solves this problem of credibility by providing moderated platforms, references from experts, and discussion forums.

Moreover, the 파토 커뮤니티 community fosters knowledge building among users, who are encouraged to provide an explanation for the information that they are posting. Users are not restricted to posting figures without providing background information about methodology, the source of the information, as well as the implications of the findings.

Practical Applications of Insights from 파토커뮤니티

- Business Strategy and Marketing

Corporations can make use of information being disseminated on 파토커뮤니티 in order to be able to gauge market trends and behavior patterns of their customers and rivals. Such an approach is highly useful in designing campaigns and launching products.

- Investment and Financial Planning

For investors, having access to real-world data and being able to chat about market trends is a big influencer on decision-making. 파토 커뮤니티 contains information regarding investment strategy, risk, and financial analysis that enables informed and calculated decisions.

- Skill Development for Professionals

Besides business and finance, information on 파토커뮤니티 would enhance professional development: people can learn about new analytical techniques, the best practices which increase job prospects.

- Community Research and Learning

Investigators, as well as students, will find beneficial the deep well of information available through 파토 커뮤니티. This is a communal resource that allows access to several points of view, cases, and data that can be used to supplement research.

Encouraging Active Participation

When The success of 파토커뮤니티 relies on participation. The more one participates, the more pool of knowledge one will be exposed to. The participation makes 파토커뮤니티 successful. Participation not only benefits the person as an individual but helps to build a stronger network as a whole. Posting of exclusive knowledge, commenting, and questioning falls under a collaborative learning process.

Furthermore, active involvement may add to the community credibility. Those users who regularly and accurately take part in the community will be recognized, and this recognition may add to professional networking.

Conclusion

In today’s information age, having access to platforms such as 파토커뮤니티 or 파토 커뮤니티 is nothing short of gold. They not only provide information, but they provide a community where information can be shared, tested, and then activated to improve decision-making capabilities. The list goes on with respect to using 파토커뮤니티 to improve business decision making or personal development.

Through the promotion of transparency, collaboration, and participation, 파토 커뮤니티.com ensures not only the availability of information to the user but also the skills needed to decode and apply the information. For any individual looking for credible and applicable insights, membership in 파토 커뮤니티 really represents the first step toward making smarter decisions.

-

Finance3 years ago

Finance3 years agoProfitable Intraday Trading Advice For Novices

-

Gaming2 years ago

Gaming2 years agoPixel Speedrun Unblocked Games 66

-

Gaming3 years ago

Gaming3 years agoSubway Surfers Unblocked | Subway Surfers Unblocked 66

-

Internet3 years ago

Internet3 years agoWelcome to banghechoigame.vn – Your One-Stop Destination for Online Gaming Fun!

-

Gaming3 years ago

Gaming3 years agoMinecraft Unblocked Games 66 | Unblocked Games Minecraft

-

Gaming3 years ago

Gaming3 years agoGoogle Baseball Unblocked | Google Doodle Baseball Unblocked 66

-

Internet3 years ago

Internet3 years agoPremium Games Unblocked: Unleash Your Gaming Potential

-

Gaming3 years ago

Gaming3 years agoTunnel Rush Unblocked | Tunnel Rush Unblocked 66