Finance

An Introduction to Cryptography – Protecting Data in the Digital Age

The proliferation of data in our connected world has opened up new avenues for hackers, governments and businesses. This raises concerns about privacy infringement, surveillance and misuse of personal information.

Cryptography, or cryptology, addresses these issues by preventing unauthorized third parties from reading private messages and transmissions. It is a fascinating field with an ancient heritage.

Encryption

Cryptography is the science of securing communications and information in digital form by changing it into something unreadable for unauthorized users. It uses various mathematical algorithms to encrypt messages so only the intended recipient can read them. This can be done through techniques like encryption and hash functions. The internet is a great invention, but it also makes it easy for hackers to steal personal information and money from unsuspecting users. This is why cryptography is so important, and it is used in many places, such as websites with SSL certificates, VPNs, and online banking.

Cryptographic methods have been around for a long time, with Julius Caesar being an early user of modern ciphers when communicating with his governors and officers. The concept is simple: a message is changed by replacing each meaningful letter with a different note, or syllable, three positions ahead in the alphabet. This creates a new directive called ciphertext, and only those who know the correct key can decipher it back into the original message.

Cryptography and its types are mostly used for data protection online and in other electronic communication channels. This is because the internet is open and accessible to anyone, including snoopers, and protecting information in transit can be very difficult. Other uses for cryptography include ensuring that financial transactions remain secure and documents are not modified during transmission.

Key Management

Cryptography has become an integral part of modern communication and commerce. It is used in bank cards, computer passwords and e-commerce websites to code messages to ensure that only the intended recipient can read them. It is also at the heart of digital rights management (DRM), a set of techniques for technologically controlling the use of copyrighted material. The foundation of most cryptography lies in mathematics, including linear algebra and arithmetic. It also uses physics, statistics and engineering. Modern cryptography focuses on message confidentiality and includes algorithms for secure computation, sender/receiver identity authentication and digital signatures.

One of the most important aspects of cryptography is key management. It involves creating, protecting, storing, exchanging and replacing keys. This is critical to the security of a cryptosystem because, without the right controls in place, a malicious actor could gain access and potentially steal or alter data. For example, if an encryption key is hard-coded into open-source software or otherwise inadvertently compromised, the encrypted data it secures will be vulnerable. In addition, compliance standards and regulations such as PCI DSS, FIPS and HIPAA expect organizations to follow best practices when managing cryptographic keys. For this reason, it’s important to never hard-code any encryption key values and regularly change them out for increased security.

Signatures

Cryptography is the study of techniques for securing information and communications so that only intended recipients can read it. It uses algorithms to scramble data into code so unauthorized users cannot understand it. It can be used to encode both intelligible text and binary data. There are three main types of cryptography: symmetric key encryption, asymmetric key encryption and public-key encryption.

The most common use of cryptography is in electronic signatures. These are more secure than a handwritten signature and confirm the authenticity of a document or message. They also prevent documents from being altered and are legally enforceable. Cryptography is also used to verify identity, protect privacy and create a chain of trust in digital communication. This is important for businesses that deal with sensitive and private information. For example, the financial industry uses cryptography for paperless banking, contract signing, loan processing and mortgage documentation. It also uses it for email nonrepudiation and to manage the blockchain in cryptocurrency transactions.

The study of cryptography has been around since the invention of electronic digital communication. It allows us to keep our personal and business data secure online. The modern digital world would not exist without it. The Internet of Things relies on cryptography, from securing the connections between devices to encrypting data to protect against hackers and data breaches.

Diffie-Hellman Algorithm

The Diffie-Hellman algorithm allows two parties to establish a shared secret without sending information over an insecure network. It is one of the most fundamental techniques used in cryptography, and it provides a method for secure communication that cannot be compromised by eavesdropping. Unlike other types of engineering, cryptography deals with active, intelligent, evil opposition and does not deal with neutral natural forces. As such, it requires a wide range of mathematical subdisciplines, including information theory, computer science, mathematics, physics, algebra, combinatorics, and number theory. A famous example of a cryptographic system is the Caesar cipher, invented by Julius Caesar in 44 BCE to communicate with his generals and governors. It works by changing the original human-readable text into gibberish, or ciphertext, that only intended recipients can read. To return the message to its original form, the ciphertext must be decrypted using a key known only to the sender and recipient. A common threat to cryptography is a man-in-the-middle attack. This occurs when an active attacker, such as an eavesdropper or hacker, pretends to be Alice and Bob simultaneously, allowing her to intercept messages being exchanged between them. In addition, she can decrypt and re-encrypt the news to give herself access to the information being transmitted. This is why other authentication methods are crucial, such as a digital certificate or an SSL (Secure Sockets Layer) certificate.

Finance

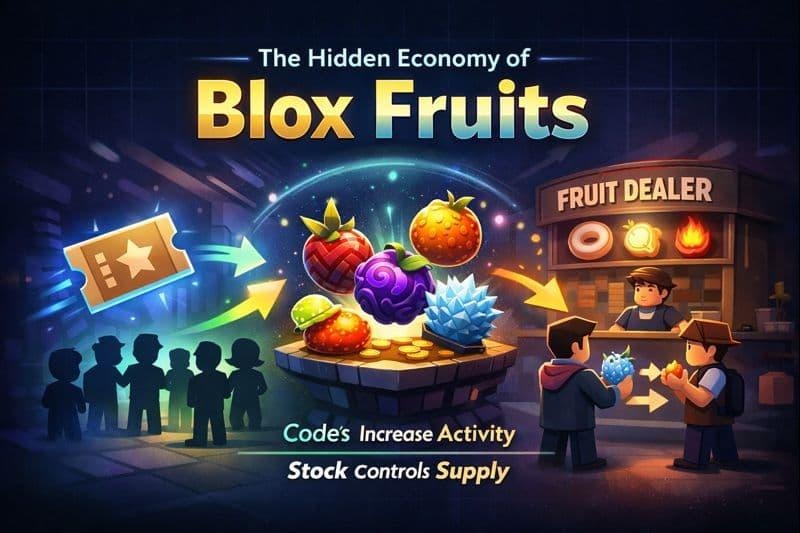

The Hidden Economy of Blox Fruits Codes Stocks and Trade Value Together

When you spend enough time inside Blox Fruits, you slowly realise that the game is not only about grinding or fighting bosses. There is a silent economy running in the background. Most players do not notice it clearly. The thing is very clear here. Codes, shop stock, and trade values are not isolated systems. They move together and affect each other all the time.

Many players treat these parts as separate. Codes feel like free rewards. Stock feels like a waiting game. Trading feels like luck. Once you connect these systems, the entire game starts feeling more logical and less confusing.

Understanding the Economic Layer Inside Blox Fruits

Blox Fruits does not show you charts or numbers like real markets. Still, the behavior feels very similar. Demand rises and falls. Supply changes with time. The player’s mindset decides value.

This economy mainly depends on three connected parts.

- Codes that increase activity and progression speed

- Fruit dealer stock that controls availability

- Trading values shaped by player demand and belief

When one part moves, the others react. That reaction is what creates value shifts.

How Codes Act Like Market Energy

Codes in Blox Fruits usually give EXP boosts or stat resets. On the surface, this looks harmless. The point is simple here. Codes push many players to level up faster at the same time.

When large numbers of players redeem codes together, a few things start happening.

- More players reach higher levels faster

- More players enter trading earlier than usual

- Demand for strong fruits increases suddenly

This demand increase happens without adding new fruits into circulation. That imbalance slowly changes trading behavior.

After major code releases, players usually want fruits that help grinding or PvP. This is why value movement feels sudden during these periods.

Fruit Dealer Stock Controls Scarcity

The fruit dealer stock decides which fruits feel common and which feel rare at any given time. Even a powerful fruit feels ordinary when it appears in stock repeatedly.

When a high demand fruit shows up in stock, the market reacts quickly.

- New players buy the fruit directly

- Traders expect short term value drops

- Trading activity slows for that fruit

Once the stock rotates out, scarcity returns. Players who waited benefit the most.

Codes indirectly affect this system too. Faster progression means more players checking stock often, which increases buying pressure during good rotations.

Trading Values Are Built by Players

Trading values in Blox Fruits are not fixed by the game. They are decided by players through shared belief and demand.

A fruit feels valuable when players believe it is valuable.

That belief usually comes from a mix of factors.

- How useful the fruit feels in grinding or PvP

- How recently the fruit appeared in stock

- How many players are actively searching for it

This is where many blox fruits trade and value calculators naturally come into the picture. Players want reference points to avoid bad trades. These tools do not control value. They reflect what the community thinks at that moment.

When stock or code activity changes, calculator values also shift. Nothing stays static.

The Loop That Keeps the Economy Alive

The hidden economy works in a repeating cycle.

- Codes increase player activity

- Higher activity increases fruit demand

- Stock controls which fruits stay scarce

- Scarcity shifts trading values

- Trading behavior reinforces demand

After that, the cycle repeats. This loop explains why sudden value spikes or drops feel confusing when you look at only one system.

Why New Players Struggle With Trading

New players usually enter trading without understanding this loop. A trade feels unfair because the context is missing.

Common mistakes new players make include.

- Ignoring recent stock rotations

- Trading right after major code drops

- Relying only on rarity instead of demand

Once you start watching patterns instead of individual trades, confidence improves.

How Long Term Players Stay Ahead

Experienced players usually follow quiet strategies.

- They trade after stock rotations end

- They wait during heavy code activity

- They store fruits during temporary demand drops

This approach is not about luck. It is about timing and patience.

External Rewards Also Influence the Economy

Player entry into the game also affects demand. Many players join after earning rewards outside the game.

Some players enter Blox Fruits after using Play store codes to redeem from reward apps or promotions. This increases new player activity in early seas. Early demand rises. Entry level fruits gain short term value.

Small changes become big when player numbers grow.

Final Thoughts on the Hidden Economy

Blox Fruits feels deeper once you stop viewing systems separately. Codes, stock, and trading values are connected gears. When one turns, the others move.

Understanding this ecosystem reduces frustration and improves decision making. Trades feel planned instead of risky. Progress feels earned instead of random.

Finance

The Importance of Data Analysis Insights Shared on 파토커뮤니티

In today’s digital age, information is no longer merely a source of power; rather, information is considered the currency of success. Anyone related to businesses, be it professionals, is constantly in search of authentic information that helps in making informed decisions. This is where platforms like 파토커뮤니티 step in as a key decision-support mechanism for those desiring success in today’s ever-changing digital world.

Why Data Analysis Matters Today

Data analysis is no longer a luxury but a required element. Every business decision, marketing decision, and personal development decision involves interpreting data. Correct interpretation can lead to the identification of trends and may indicate opportunities that could be overlooked. Decisions are often made on assumptions and may be made on incomplete information when the insights are not available.

Platforms like 파토커뮤니티 allow users to access diverse pieces of knowledge and insight collated through the members of the community. In communities such as 파토 커뮤니티, knowledge collation is not a matter of personal opinion but rather data culled from experiences and expertise in various fields from different individuals. This makes the knowledge base richer and more reliable for anyone approaching it.

Benefits of Sharing Insights about 파토커뮤니티

- Enhanced Decision-Making

The use of platforms such as 파토커뮤니티 offers a number of major benefits, improving decision-making. In this way, users can observe the trend of data, strategies comparisons, or even the forecast of results based on information given by the community. For instance, a person looking for investment opportunities or online marketing may look at information from previous members based on data shared.

- Collaboration and networking opportunities

파토 커뮤니티is more than just data. It is people. The idea to share knowledge stimulates collaboration. It enables people to connect with other professionals in other fields. This is where collaboration may lead to new innovative thoughts that, through isolation, it seems impossible to attain. PaTo Community is people-centered, ensuring that knowledge is derived from real-life experiences and not from simulated situations.

- Problem Solving & Strategy Formulation

Each profession develops its own set of challenges, be it process optimization, resource management, or analyzing market dynamics. Members on 파토커뮤니티 regularly share case studies, methods, and approaches which have helped them solve a similar problem. Real-life experiences are always more precious compared to advice that is purely theoretical.

- Current Information and Trends

The Internet is a world that keeps on changing. The need to catch up with every minute evolution makes it crucial, and the 파토 커뮤니티 ensures this by letting its consumers spread the latest trends, reports, and discovery information available so that all members can communicate with the latest information coming. This news can be a game changer for entrepreneurs whose data becomes stale tomorrow.

How 파토 커뮤니티 Ensures Reliable Insights

One issue that online platforms for data sharing may present is the issue of credibility. The information that users of such platforms may be exposed to may be inaccurate or influenced by a certain point of view that may be misleading. 파토커뮤니티 solves this problem of credibility by providing moderated platforms, references from experts, and discussion forums.

Moreover, the 파토 커뮤니티 community fosters knowledge building among users, who are encouraged to provide an explanation for the information that they are posting. Users are not restricted to posting figures without providing background information about methodology, the source of the information, as well as the implications of the findings.

Practical Applications of Insights from 파토커뮤니티

- Business Strategy and Marketing

Corporations can make use of information being disseminated on 파토커뮤니티 in order to be able to gauge market trends and behavior patterns of their customers and rivals. Such an approach is highly useful in designing campaigns and launching products.

- Investment and Financial Planning

For investors, having access to real-world data and being able to chat about market trends is a big influencer on decision-making. 파토 커뮤니티 contains information regarding investment strategy, risk, and financial analysis that enables informed and calculated decisions.

- Skill Development for Professionals

Besides business and finance, information on 파토커뮤니티 would enhance professional development: people can learn about new analytical techniques, the best practices which increase job prospects.

- Community Research and Learning

Investigators, as well as students, will find beneficial the deep well of information available through 파토 커뮤니티. This is a communal resource that allows access to several points of view, cases, and data that can be used to supplement research.

Encouraging Active Participation

When The success of 파토커뮤니티 relies on participation. The more one participates, the more pool of knowledge one will be exposed to. The participation makes 파토커뮤니티 successful. Participation not only benefits the person as an individual but helps to build a stronger network as a whole. Posting of exclusive knowledge, commenting, and questioning falls under a collaborative learning process.

Furthermore, active involvement may add to the community credibility. Those users who regularly and accurately take part in the community will be recognized, and this recognition may add to professional networking.

Conclusion

In today’s information age, having access to platforms such as 파토커뮤니티 or 파토 커뮤니티 is nothing short of gold. They not only provide information, but they provide a community where information can be shared, tested, and then activated to improve decision-making capabilities. The list goes on with respect to using 파토커뮤니티 to improve business decision making or personal development.

Through the promotion of transparency, collaboration, and participation, 파토 커뮤니티.com ensures not only the availability of information to the user but also the skills needed to decode and apply the information. For any individual looking for credible and applicable insights, membership in 파토 커뮤니티 really represents the first step toward making smarter decisions.

Finance

Understanding XAUUSD in Forex Trading: The Ultimate Guide to Gold Trading

Only a few assets can match the popularity of XAUUSD in the forex landscape. XAUUSD is a trading pair that reflects the price of the precious metal gold expressed in American dollars (USD). Traders who understand the full meaning of XAUUSD and XAU CCY (another local currency) can improve their knowledge of price movements and volatility, to make smarter trading decisions.

A Comprehensive Guide to Understanding XAUUSD

To put things in context, the term XAUUSD indicates how many American dollars are required to buy one troy ounce of gold. For instance, if the market price of XAUUSD = 10,020, then it means that one ounce of gold costs $10,020 USD. Forex traders use the term XAU to represent one troy ounce of the valuable commodity gold. Investors can choose to purchase and sell XAUUSD pairs depending on the predicted price trend of gold on the market.

Why Gold Is So Vital in the Forex and Commodities Ecosystems

Several reasons explain why gold takes the lead when it comes to the subject of precious metals trading. Not only is it regarded as a safe asset, but investors also tend to buy the commodity to protect themselves when the stock market falls or inflation shoots through the roof. Are you wondering whether putting your money into gold is a wise idea or not? Well, please take a quick at these key points explaining a few reasons to buy gold

- Protect your Investment Against Inflation

Gold has the potential to maintain or increase its worth even when regular fiat or paper currencies depreciate. This is why investors use it to hedge against inflation. You can click this site for more info on XAUUSD pair trading opportunities.

- High Liquidity

Another great reason why many investors prioritize the XAUUSD pair is that it is one of the most actively traded instruments in global markets.

- High Global Demand

The majority of central financial institutions and private investors opt for gold for security and diversification. A few factors that often determine XAUUSD prices include strength of the dollar, inflation, and geopolitical issues like conflicts and elections.

Where Can You Trade the XAUUSD Pair Online?

Choosing the right broker is always essential, whether you are trading CFDs, synthetic indices, currency pairs, or commodities like gold and silver. As a tip, you will want to select a platform that offers low spreads for tighter cost control, fast order execution to handle gold’s high volatility, and complies with industry regulation for peace of mind. When it comes to trading XAUUSD and other commodities online, Weltrade stands out as one of the best global brokerage sites providing traders access to over 70 currency pairs, commodities, and precious metals. This top broker also supports the MetaTrader 5 (MT5) platform for advanced charting, analysis, and trading tools. Weltrade’s transparency and reliability make it a top choice for traders looking to diversify their portfolio beyond currencies into commodities like gold, silver, and oil. You can open a Weltrade live account or free demo account today to practice trading XAUUSD under real market conditions.

Overall, trading XAUUSD offers immense potential for profit due to its volatility, high liquidity, and global demand. As an asset that historically preserves value, gold remains one of the best instruments for traders seeking both stability and opportunity. You can maximize your success by always trading through a reputable broker like Weltrade, which provides the tools, technology, and trust you need to confidently trade gold and other commodities on the world’s most advanced platforms. Once you start your journey today, you can learn the patterns, master risk management, and take advantage of every market move in XAUUSD trading.

-

Finance3 years ago

Finance3 years agoProfitable Intraday Trading Advice For Novices

-

Gaming2 years ago

Gaming2 years agoPixel Speedrun Unblocked Games 66

-

Gaming3 years ago

Gaming3 years agoSubway Surfers Unblocked | Subway Surfers Unblocked 66

-

Internet3 years ago

Internet3 years agoWelcome to banghechoigame.vn – Your One-Stop Destination for Online Gaming Fun!

-

Gaming3 years ago

Gaming3 years agoMinecraft Unblocked Games 66 | Unblocked Games Minecraft

-

Gaming3 years ago

Gaming3 years agoGoogle Baseball Unblocked | Google Doodle Baseball Unblocked 66

-

Internet3 years ago

Internet3 years agoPremium Games Unblocked: Unleash Your Gaming Potential

-

Gaming3 years ago

Gaming3 years agoTunnel Rush Unblocked | Tunnel Rush Unblocked 66